Why Tax Allocation Matters

When it comes to investing, where you invest your money can be just as important as what you invest in. The types of accounts you use can affect your taxes now and in the future. There are three main types:

1. Taxable Accounts

These are regular investment accounts, not tied to retirement. You can buy and sell anytime. There are no special tax benefits, but you have full access to the money.

2. Tax-Deferred Accounts

These include accounts like Traditional 401(k)s and IRAs. You often get a tax break now, but you’ll pay taxes later when you take the money out. Tied up til retirement (if you want to avoid penalties.

3. Tax-Free Accounts

These include Roth IRAs, Roth 401(k)s, and HSAs. You pay taxes up front, but not when you take the money out later, if used correctly. Also tied up til retirement.

Over time, your mix of these account types, aka your tax allocation, can impact everything from your flexibility to your total lifetime tax bill.

Let’s look at three real-life examples:

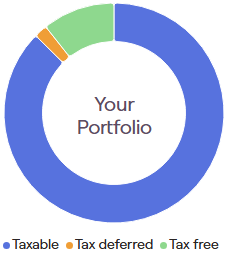

Someone with a Taxable-Heavy Portfolio

They have max flexibility. They can use the money whenever, sell without penalties, give to charity in tax-smart ways, and time gains or losses. But if they never use retirement accounts, they’re likely paying more in taxes than they need to. They’re missing out on tax-deferred or tax-free growth.

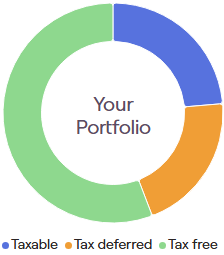

Someone with a Tax-Free Heavy Portfolio

It sounds great! You have tax-free withdrawals at retirement. But if you always contribute to Roth accounts, especially during high-income years, you might be paying more taxes than necessary over the course of your life.

The key to contributions to Roth accounts is to use them in tax years when your income is lowest. Use traditional when your income is high, then convert to Roth later in lower-income years, like early retirement or a gap year. Another benefit of Roth is certainty. We can’t predict what taxes will look like in the future, but now you’ll know you will be in the clear.

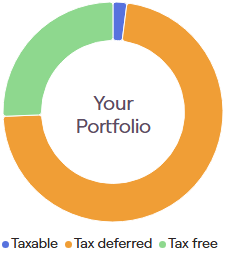

Someone with a Tax-Deferred Heavy Portfolio

You’re getting the tax break now, but there are tradeoffs. You’ll owe taxes on every dollar in retirement, so you have to save more to cover the future tax bill. And once you hit your 70s, the government forces you to take money out through Required Minimum Distributions, which could push you into a higher tax bracket. We call this the “tax bomb.”

If you are in a lower tax bracket now, it may benefit you to contribute to Roth accounts moving forward or utilize Roth conversions.

There’s no perfect ratio. It’s about understanding where you are, where you're going, and what type of flexibility or tax treatment you’ll want down the road.

If you’ve got extra money to invest, ask: Which type of account gets me closer to where I want to be?